Experience the Thrill of Aztec Paradise Casino & Sportsbook -2116154811

03/11/2025Tretinoin 0.05 gel Vodič za korištenje i prednosti

03/11/2025

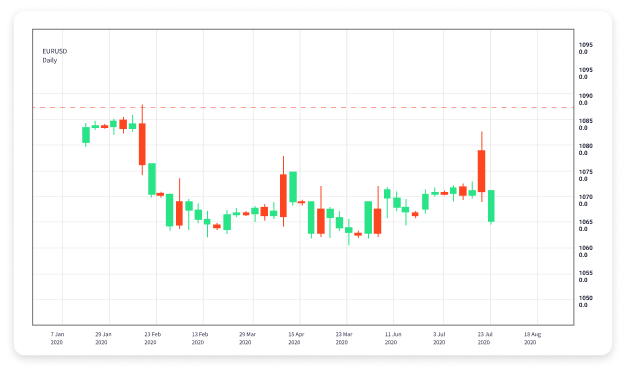

Forex prop trading firms play a pivotal role in the financial trading ecosystem. These firms provide traders with the necessary capital to trade on the Forex market, allowing them to execute trades without risking their personal funds. This unique model offers an exciting opportunity for both seasoned traders and newcomers. A notable mention is forex prop trading firms UAE Brokers, who have been gaining popularity in this realm.

What are Forex Prop Trading Firms?

Proprietary trading firms, commonly referred to as prop firms, are companies that engage in trading financial instruments, including currencies, with their own capital. Unlike traditional brokerage houses that act as intermediaries between buyers and sellers, prop firms allow traders to use the firm’s capital to make trades, often in exchange for a percentage of the profits generated.

How Forex Prop Trading Firms Operate

Prop trading firms typically employ talented traders and provide them with resources and infrastructure needed to thrive in the Forex markets. These firms may also offer training programs to improve the skills of their traders, thus fostering a culture of continuous learning and improvement.

Profit-Sharing Model

The profit-sharing model is a critical aspect of how these firms function. Traders at prop firms often earn a percentage of the profits they generate. This arrangement incentivizes traders to perform effectively while minimizing the risk of loss since the financial risk is borne by the firm. The profit split can vary widely depending on the firm and the trader’s performance.

The Advantages of Joining a Forex Prop Trading Firm

There are several advantages to becoming a trader at a Forex prop trading firm:

- Access to Capital: Traders have the advantage of trading with the firm’s capital, allowing them to engage in larger trades without needing to use their own money.

- Reduced Financial Risk: Since the firm covers the losses, traders can experiment with different strategies without the fear of depleting their personal funds.

- Professional Environment: Prop firms often provide a professional trading environment complete with cutting-edge tools, software, and market research, which can enhance the trading experience.

- Training and Support: Many prop firms offer extensive training and mentoring, providing traders with valuable resources to develop their skills.

Challenges of Forex Prop Trading Firms

Despite their advantages, there are also challenges associated with trading at prop firms:

- Structured Trading Conditions: Prop firms may impose strict rules regarding trading strategies, risk management, and position sizes, which could limit a trader’s freedom.

- Pressure to Perform: The competitive nature of prop trading can create pressure on traders to consistently deliver results, which can lead to stress and burnout.

- Variable Profit Splits: Depending on performance, traders might find that their profit-sharing percentages change, which could affect their overall income.

How to Choose the Right Forex Prop Trading Firm

When considering joining a prop trading firm, it is essential to conduct thorough research and consider various factors:

- Reputation: Look into the firm’s reputation in the industry. Check reviews and testimonials from current and former traders.

- Profit Split: Understand the profit-sharing model and consider if it aligns with your financial goals.

- Training Programs: Evaluate the quality of training and mentorship offered as they can significantly impact your success.

- Trading Conditions: Ensure that the trading conditions align with your trading style, including leverage, spreads, and available trading instruments.

- Regulation: Confirm that the firm adheres to relevant regulations and has a safe trading environment.

The Future of Forex Prop Trading Firms

The landscape for Forex prop trading firms continues to evolve with advancements in technology and changes in trading regulations. As more individuals seek flexible career options in trading, the demand for these firms is likely to increase. Additionally, the incorporation of technology, such as automated trading systems and AI analytics, is reshaping how prop trading firms operate, offering new opportunities and challenges to traders.

Conclusion

Forex prop trading firms offer a unique opportunity for traders to engage in the forex market without the need for substantial personal capital. While there are advantages such as access to capital, professional environments, and reduced financial risks, traders must also be aware of the challenges that come with such arrangements. By carefully selecting the right prop trading firm, traders can take significant steps toward achieving their financial goals in the forex market. As the industry continues to grow and evolve, so too do the prospects for aspiring traders in this dynamic field.